As of July 1st 2021 there are a few changes in VAT-rules for eCommerce within the European Union. This article describes how the relevant changes can be set up within Lightspeed eCom.

1. Thresholds

Currently in the EU, the threshold to register and collect VAT depends on the country in which your business is based. These individual thresholds per country will disappear: there will be one single threshold of €10.000 for distance selling to all other EU-countries. As of the order that will exceed €10.000 of export value in total, you will need to charge the local VAT(i.e. the VAT rate of the EU-country of the consumer). In eCom, you can do this by setting up regional tax overrides.

As an eCom merchant you’ll track the total value of exports yourself: perhaps you’re selling via different channels that are not integrated with Lightspeed eCom. Within eCom you can use the Orders export.

- Go to Tools > Exports and start and download the Orders export.

- Delete the orders that have a credit note. You can remove every line that has a value under Credit_notes.

- Now you can filter by Country (column AG) and show only the countries within the European Union. The country where you are based should not be included.

- Insert a sum of the Product_price (column AQ) to calculate the total value.

In 2021, the threshold is effective on orders after July 1st. For the subsequent years, the calculation starts on January 1st. When you have exceeded the threshold in the previous year, then you can continue using the local VAT from the beginning of the next year.

If your cross-border sales stay under €10,000 per year, you are considered a ‘micro-business’ and you may apply your home country’s VAT rules, charging your local rate on all B2C sales and filing as usual.

Tips

- Carefully select the countries under Settings > Store Country: only select the countries where you want to ship to.

- Create a regional tax override for all the countries within the European Union as soon as you reach the €10.000 threshold

- You can sign up for the One Stop Shop to file and remit VAT for all countries together. This is not mandatory, but makes remitting taxes easier: you’ll be able to register for VAT and file your VAT returns in a single country. The system is available to both EU merchants and non EU merchants.

The one-stop nature comes from the fact that businesses register for VAT in just one EU country, rather than in multiple. Local businesses obviously register in their home country, but non-EU businesses can choose any member state to act as their VAT host. Then all pan-EU sales will be included in a single OSS tax return.

2. Importing goods from outside the EU into the EU

When you’re importing products from outside of the EU, the products are charged with import tax in the EU-country where the products arrive. This is the case when an order is shipped to someone who’s not subject to VAT: consumers or businesses without VAT-responsibilities. In the past, packages with a value under €22 were exempt from VAT, as of July 1st, VAT is charged for all packages.

Example: your products are located in China and via an order in your webshop they will be delivered directly to a customer in Germany. These products are subject to German VAT, so import taxes will need to be paid.

As a merchant, you have two options: you can choose to charge Import VAT at the point of sale, or not.

- Continue business as usual

It is not mandatory to charge import VAT at the point of sale, companies can choose to stick to a more traditional route of using customs. The delivery carrier will charge the consumer with import VAT. This option will be easiest for you as a merchant, but might create a bit more friction and delays for the consumer. - Charge import VAT at checkout

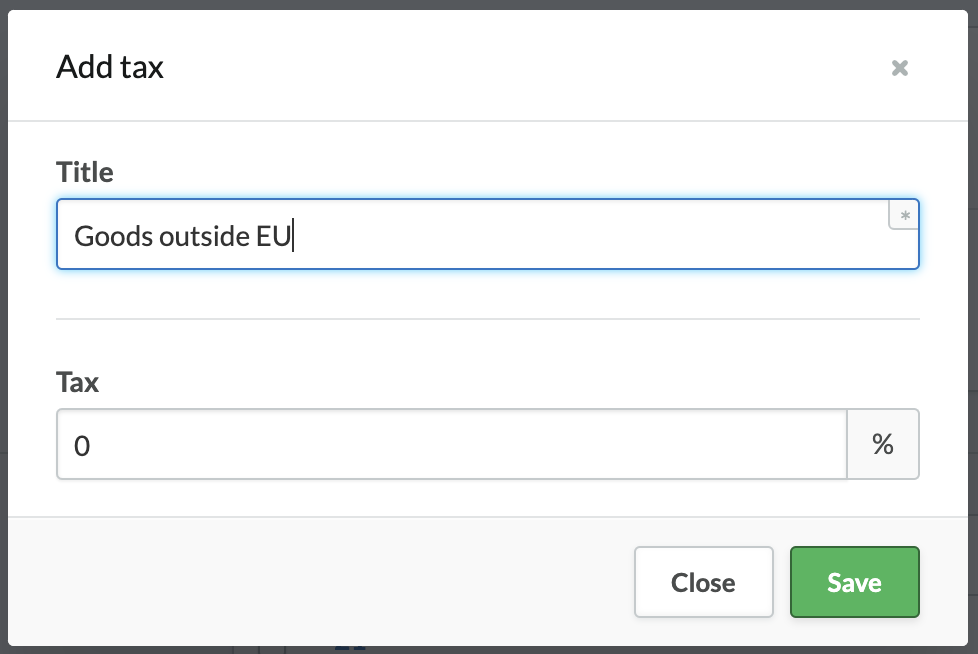

If you want to charge import VAT in eCom, go to Settings > Taxes to add a new Tax rate. This rate will be specific for the products that are shipped from outside the EU to the consumer directly; it is recommended to use a clear title to recognise this. Under Tax you enter the rate for import tax:

Now, add regional tax overrides for every country within the EU where you are importing into to (the list under Settings > Store Country). Choose Combine with Federal Tax to combine the two rates.

Consider whether you want to register for the Import One Stop Shop scheme, for goods up to €150 in value. This will make it easier for you to report and pay taxes over the goods imported from outside the EU. This IOSS scheme is available to both EU and non-EU merchants.

Disclaimer – The information in this publication is of a general nature and is not intended to address the circumstances of any particular individual or entity. This article describes how the relevant changes can be set up in Lightspeed eCom. Although we endeavour to provide accurate and relevant information, we do not guarantee that the information in this blog post is accurate at the date it is received or that it will continue to be accurate in the future. Nothing in this blog post is intended to be relief on as advice, whether legal, financial, tax or otherwise, and this blog post is not a substitute for consulting your own professional advisors.