If your business is located in the United States or Canada, you can enable automatic tax rates for your online store. Lightspeed eCom will then generate the appropriate taxes, based on each customer's shipping location.

IMPORTANT:

- If your store is located in Europe or Australia, click here.

- It is not recommended to have manual and automatic taxes configured at the same time.

- To ensure you are charging the correct taxes, it is recommended you contact your local government.

Introduction

In order to properly setup your sales taxes, review a few sales tax concepts for the United States. Lightspeed eCom uses the customer's zip code to specify a customer's district, county, city, and state during checkout in order to charge the correct tax rates.

Nexus

In the United States, the requirement to charge taxes is based on nexus or sufficient physical presence. The definition of sufficient physical presence in a state varies state-to-state. For example, in some states, advertising in that state indicates a physical presence. In Lightspeed eCom, you should create a tax location for each state your business has nexus. It is recommended you check with the state or a tax specialist to understand your taxing requirements.

Destination or Origin

To determine the applicable taxes for purchases outside of counties, cities and districts, states use one of 3 models:

- Destination - Used by the majority of states, taxes are based on the destination of the order.

For example:

If a merchant in New York City sells to a customer living in Syracuse, Lightspeed eCom will charge the customer taxes based on Syracuse's rates. - Origin - Used by the minority of states, taxes are based on the shop's location.

For example:

If a merchant in Philadelphia sells to a customer living in Pittsburgh, Lightspeed eCom will charge the customer taxes based on Philadelphia's rates. - Hybrid-origin - If you have a eCom store based in California, you can turn on hybrid-origin settings. With the setting on, state tax is applied to all orders in California and district taxes are applied only to orders inside your shop's district. Turn the setting off to use the Destination tax model.

For example:

The hybrid-origin setting is turned on and a merchant in Los Angeles sells to a customer living in San Francisco. Lightspeed eCom will only charge the customer California state taxes. If the neighbour of the store in Los Angeles makes the same order, they would pay the state and district taxes.

Nexus in more than one state

In cases where your store's nexus exists in more than one state, the model used to determine taxes for out of state orders will be always be the destination model.

For example:

A merchant has a nexus that includes New York and Pennsylvania. A customer from New York City purchases an online order from Philadelphia. Lightspeed eCom will charge the customer taxes based on New York City's rates.

Setting up sales tax

- In your eCom Back Office, select Settings > Taxes.

- Under TAX SETTINGS, the switch for All prices exclude tax should be toggled on.

- To ensure taxes appear in your cart and checkout, toggle on the switches for Show tax in cart, and Show tax in checkout.

- Ensure the option for Tax rate for new products is be set to: Calculate taxes automatically.

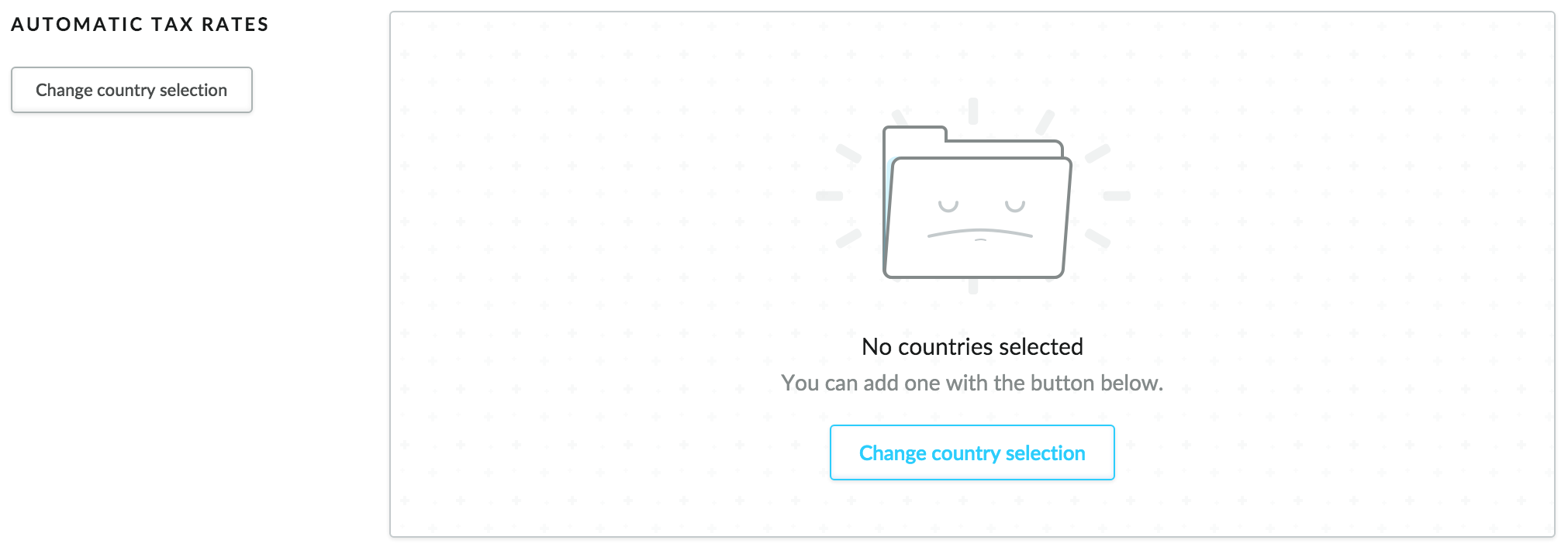

- Under AUTOMATIC TAX RATES, click Change Country Selection to select a country.

- From the list of countries select United States.

- The country is added to your automatically calculated tax rates.

- Click Edit to add tax per state.

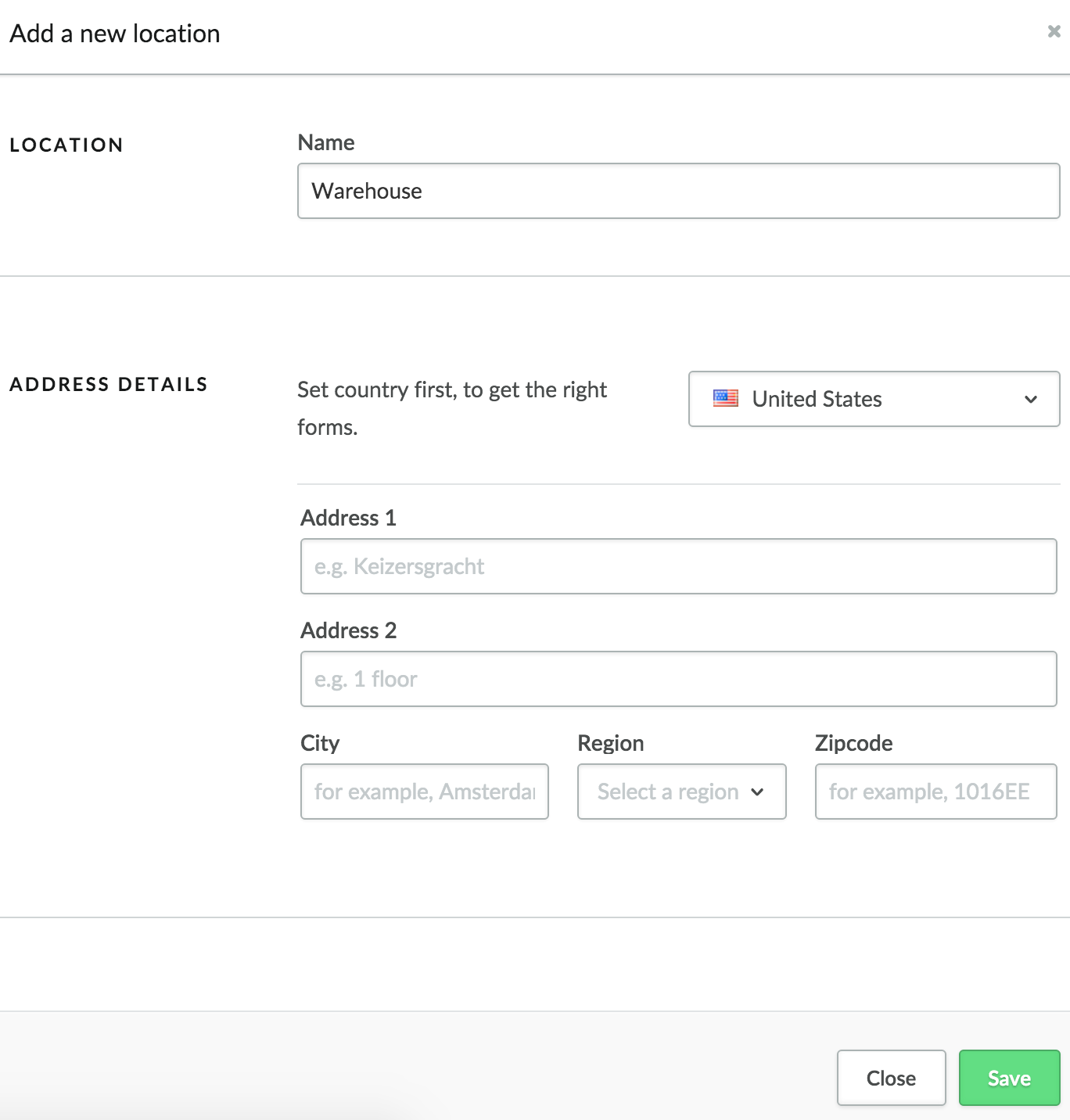

- Click Add a location.

- In the Name box, give your location a name such as Warehouse or Main Store, and enter the address. If you have only an online store, enter the address where you are located, such as your home or warehouse address.

- Repeat these steps for every location that's in a different state. If you have multiple locations in one state, you only need to enter one location.

NOTE: The tax rates for each zip code are updated monthly. If you don't see the correct rate in Lightspeed eCom, contact us and our support team can request an update for you.

Changing automatic taxes by creating a tax override

Depending on your products and your location, you may have tax exemptions. For example, many states have tax holidays.

You can create tax classes to identify products that have particular tax rate or exemption. Then you can use tax overrides to specify how much tax customers should pay for those products. It is recommended you check with the state or a tax specialist to understand tax exemptions.

Overriding taxes for a few individual items:

- Enable automatic tax rates.

- On the left menu of the Back Office click Settings > Payment Settings > Taxes.

- Click United States.

- From Tax Classes click Add a tax class.

- Give the tax class a name, such as Children's clothing.

- Click the tax class you created.

- Click Add products to click Choose beside each product to add them to the tax class.

- Click Save.

- From Settings > Payment Settings > Taxes > United States and click Add a tax override and select the tax class you created.

- For each state that you want to apply the override to, enter a rate, and optionally change the name and tax type:

- Combine with the federal tax: add the rate to the country's rate.

- Replace the federal tax.

- Compounded with the federal tax: the federal tax is applied to the subtotal, then the tax override is applied.

Overriding taxes for a group of items:

- Enable automatic tax rates.

- On the left menu of the Back Office click Settings > Payment Settings > Taxes.

- Click United States.

- From Tax Classes click Add a tax class.

- Give the tax class a name, such as Children's clothing.

- Enable Select a group of products by toggling on the switch.

- Select the radio button beside All products in the shop if you're adding all your products in your shop to this tax class.

- Otherwise, select the radio button beside Product group conditions and filter according to the product's:

- Category

- Supplier

- Brand

- Price

- Scroll down to EXCLUDE PRODUCTS and click Add product to select products you don't want to be included in the tax class.

- Click Save.

- From Settings > Payment Settings > Taxes > United States and click Add a tax override and select the tax class you created.

- In the Tax Overrides area, click the tax override to configure it.

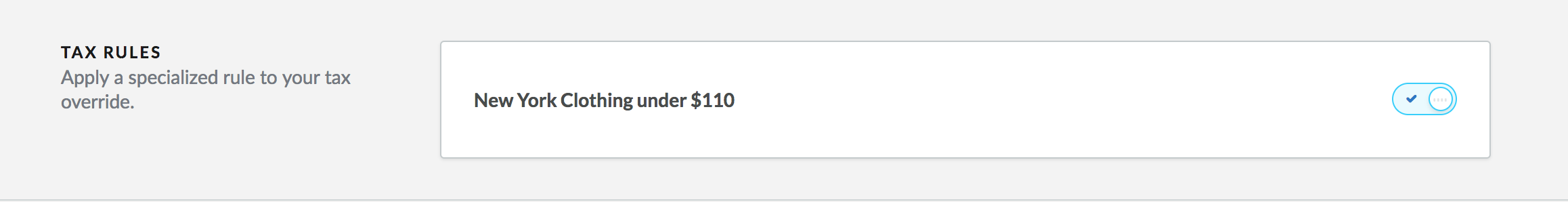

- If you are in New York state and your tax class is clothing, from Tax Rules select New York Clothing under $110.

- In the Tax Rates area, for each state that you have a store in, enter the rate.

- For each state you can optionally apply the rate to all counties and cities.

New York clothing tax override

In the tax override screen, there is a feature in the TAX RULES section called New York Clothing under $110. If you sell merchandise in New York state that is tax exempt, use this setting to quickly override your taxes.

Activating the switch for New York Clothing under $110 will exempt taxes when:

- You have added your products to a tax class and that tax class is selected in your tax override.

- The price of the product is $110 in checkout, before taxes and after discount.

- Your order's shipment is destined for an address within New York state.

Due to the various local tax laws, the amount of the tax exemption will vary by each region in New York state. The automatic taxes is designed to account for these differences. For example, in Dec. 2015, taxes charged on clothing in Albany county were 4%, whereas in Columbia county, no taxes were charged.

It is recommended you add all your tax exempt items to the tax class, despite the price. This way, if an item is discounted and the new price is under $110, no other setup is required for the tax exemption to apply. For more information on how to add many products to a tax class, click here.

Colorado retail delivery fee

As of July 1, 2022, Colorado imposes a retail delivery fee on all deliveries by motor vehicle to a location in Colorado. The fee is a flat tax rate of $0.27.

To help merchants in Colorado meet this requirement, Lightspeed eCom automatically applies this flat tax rate of $0.27 on orders if the following applies:

- Colorado is listed as a location in your automatic tax rates

- The shipping address of the order is in Colorado

- The shipping method of the order isn't set to Pickup

- The shipping method of the order has automatic taxes turned on

- The order is taxable (the total tax rate of the order isn't 0%)

If you offer non-motorized vehicle delivery, like bike couriers, you can easily bypass this automatic retail delivery fee. Simply turn off automatic tax calculations in the shipping method's settings. The retail delivery fee also won't apply if you sell non-taxable goods.

Important details about the Colorado retail delivery fee

- The Colorado retail delivery fee prints on invoices. However, it doesn't show in email notifications to customers if you're using the [[details]] key as placeholder text.

- If the Colorado retail delivery fee is applied to an order, please don't split items on separate invoices.

- If you set up your account to combine taxes at checkout, the federal, regional, and municipal taxes display as one tax rate. However, the Colorado retail delivery fee is not included in the tax rate. Instead, it displays in the tax value. For example:

- If the subtotal of an order is $100.00, the combined tax rate is 10%, and the tax value is $10.27 instead of $10.00 because the Colorado retail delivery fee applies automatically.